I recently read a blog post written by Dave Ramsey regarding the VA Mortgage loan program.

In it, Dave’s advice wasn’t just a little bit off. It was flat out wrong!

Dave has mentioned VA loans several times on his show, all with the same bad advice. In this particular case, since it’s in print, I’m going to share his blog post and point out the inaccuracies.

The question posted was:

“Is it ok to get a VA loan?”

Dave’s response is here but I’m going to post it below:

QUESTION: “Matthew and his wife are completely debt free and they are new parents. They’ve built up an $8,000 emergency fund and he’s active duty Air Force. They are renting and putting away 15% for retirement. He wants to take out a VA loan since they don’t have a down payment for a house. Is that a good idea?”

DAVE’S RESPONSE: “A VA home loan are one of the more expensive kinds of loans. It’s a veteran’s benefit, but it’s not actually a benefit because you can get a conventional loan at less fees and lower interest rates. The only advantage of the VA house loan is that you can put nothing down, which I don’t consider an advantage; it’s a trap. Save a good down payment instead of doing a VA mortgage.

You’ve done a great job and gotten out of debt, and are investing well. Maybe you might consider stopping retirement contributions for a year to get your down payment together. You’ve got the itch to buy for a couple of reasons; the baby’s here and you can see the light at the end of the tunnel as far as your military service goes. You have this emotional need to look at a house and say that you own it.”

Here’s Where Dave Is Wrong…

Ok, let’s break this down…

First of all Dave, where is your NMLS number?

Have you taken the test?

Have you taken any VA loan applications?

Do you study the VA lending guidelines day in and day out?

Of course not!

Guess what….Dave speaks from ignorance in his response here.

Let’s take a look here. Dave says….“The VA loan is one of the more expensive kind of loans.”

Um….no it’s not!

There is some misconception that the VA loan is expensive because of the VA funding fee. The funding fee is an insurance fee that’s tacked on to non exempt VA loans. In the case of the original question, active duty Air Force with first time use, this fee is 2.15% (unless the veteran is disabled).

In all cases, the VA loan will be lower than a FHA loan because the VA insurance is cheaper than FHA insurance.

Additionally, VA loans are almost always at a lower interest rate than other loan programs, with fewer pricing adjustments for low credit scores.

Ok, but what about conventional?

For a conventional loan, if someone puts down less than 20% there’s still mortgage insurance (also referred to as MI) and in these cases, the VA loan still comes out ahead due to lower interest rates.

Additionally, over 10 million eligible veterans pay no funding fee at all due to service related disabilities. It’s waived for all of them. In these cases, getting the VA loan is a no brainer.

In a few cases, doing 20% down for conventional and having no MI might be cheaper than doing VA and paying a funding fee.

Even then, having a lower rate on VA may cause it to be cheaper overall, even with the funding fee factored in. Guess what….it DEPENDS and that’s where a good loan advisor can come in handy.

Closing Costs

Dave completely missed the mark regarding closing costs with VA loans. Many lenders, including my employer, Edge Home Finance, will waive the processing and underwriting fees when processing a VA loan. That’s a $1500 savings right there!

Additionally, many title companies, including many that I work with, will drastically reduce title fees on VA loans. Due to financial regulations, they will charge the veteran full price if the veteran chooses to go conventional or FHA instead of VA. That’s another $700 in savings!

Dave says the VA loan is a trap. That’s ridiculous. So, instead this person is supposed to scrimp and save for years and years while missing out on the equity gained by paying down the mortgage and the appreciation in the home value.

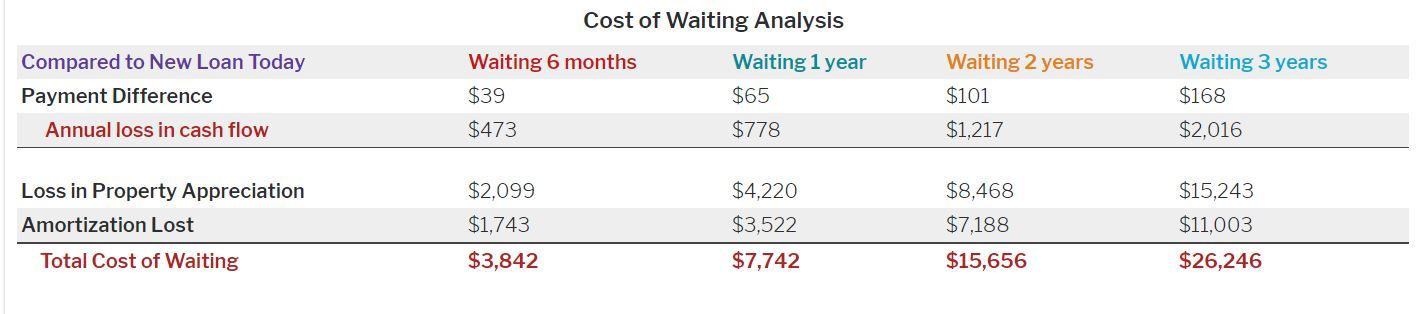

The Cost of Waiting

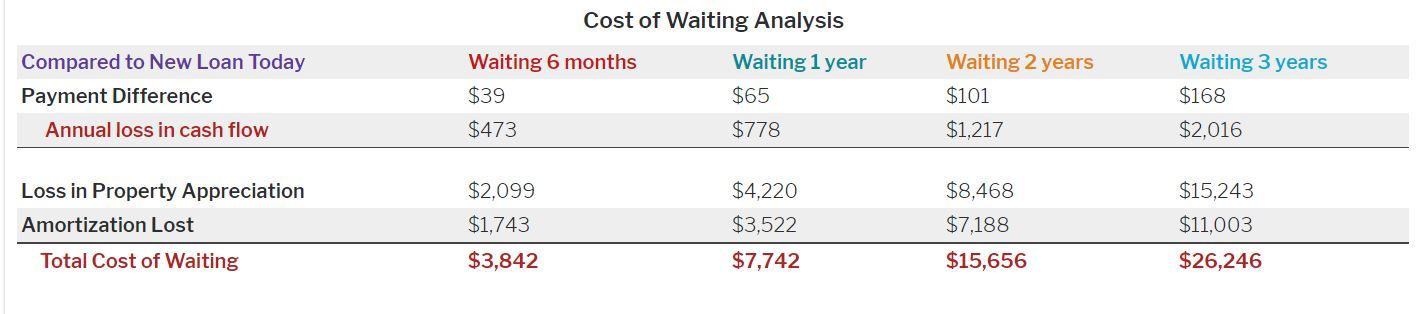

This is a breakdown of the cost of waiting. Click on the image to view it full screen.

As you can see from the analysis that I downloaded from MBS Highway, waiting 2 years can cause $8468 in lost property appreciation and $7188 in lost amortization, for a total of $15,656 based on a $200,000 purchase price.

This is based on the Dayton, Ohio metro area property values and we tend to appreciate slower than the national average. In other markets, the cost of waiting is even worse.

This is also assuming no increase in interest rates. We are close to the bottom of the market right now, so most likely the rate 2 years from now will be higher than today’s rates. If rates, rise, the cost of waiting will be worse.

What should Matthew do?

What advice would I give Matthew, the person who wrote the original question?

Well, I have no idea.

I know nothing about his true financial picture.

What are his goals?

What is his income?

What does his credit look like?

Does he think he will move soon?

Does he plan to stay in the Air Force long term?

Is his wife working?

Is he eligible for a service related disability rating?

We don’t know.

That’s what true financial advice is. It takes a bit more than a paragraph of info to give any sort of advice on something so important.

If he is going to stay put for a while, VA can be a GREAT option.

Saving for conventional because VA is a “trap”? NO WAY!