Mortgage rates are at new lows again.

You may be wondering if now is a good time to refinance your mortgage. Here is a simple formula that you can use to see if the refinance is worth doing.

Closing Costs Divided by the Monthly Payment Amount Saved = Recoupment Time.

You want the recoupment time to be as low as possible. If you end up selling the home before you have time to recoup your

closing costs, then the refinance was not a good deal for you.

There’s no right or wrong answer for ideal recoupment time, but I typically don’t recommend a refinance if it’s going to take you longer than 36 months to recoup your closing costs.

Here’s an example of the formula in action:

$3000 in closing costs divided by $150 a month in savings=20 months recoupment time.

In the example above, the refinance may be a good deal if you are planning on staying in the home for 20 months or longer.

Why It’s Better To Avoid Paying Points and Take The Lender Credit (Reverse Points) Instead

Loan officers get a chuckle when we hear others (especially Realtors) quoting rates. There are so many factors involved in a rate quote: the credit score, what type of loan it is, the term of the loan, whether you want the par rate or you want to pay points to buy it down or want to pay the higher rate and take the lender credit.

For a refinance, it’s better to take the lender credit and lower the closing costs.

Remember the recoupment formula above?

By using lender credit to lower closing costs, the recoupment time goes down, making it more likely that the closing costs are recovered.

In many cases, you can get enough lender credit to cover ALL the closing costs. This is truly “free money savings!”

Avoid the Phoney “Savings”

If you are refinancing back into a 30 year term, you need to consider the fact that you are now “resetting the clock”. Sure, the savings can look good, but is it really savings or just an illusion?

The best way to figure this out is to use a prepayment calculator. This calculator shows how much you would save if you reinvested your

refinance savings as a principal only payment back into the new loan.

There are a few different calculators online that you can use to determine prepayment savings, but my favorite one is the one

located here.

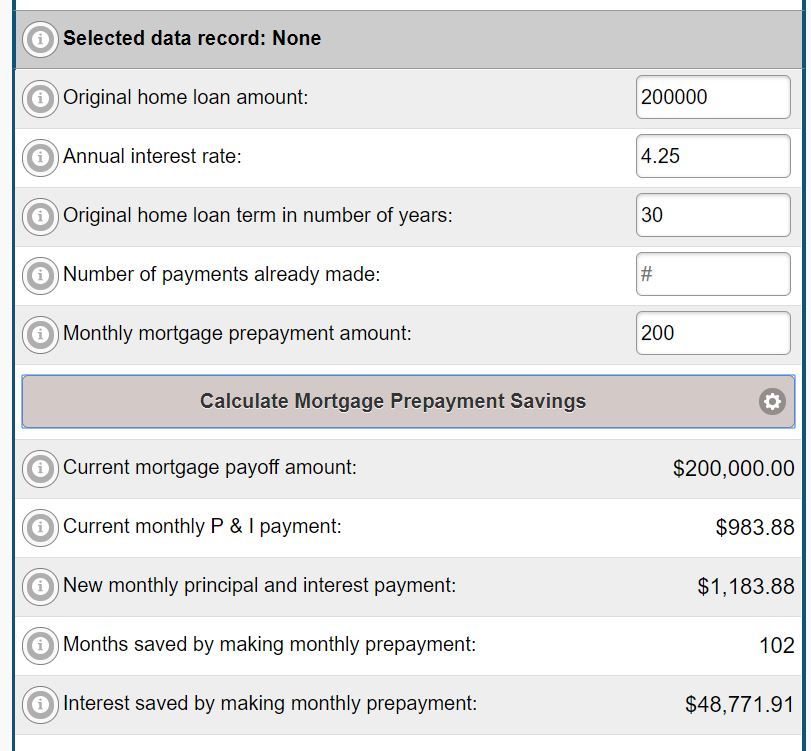

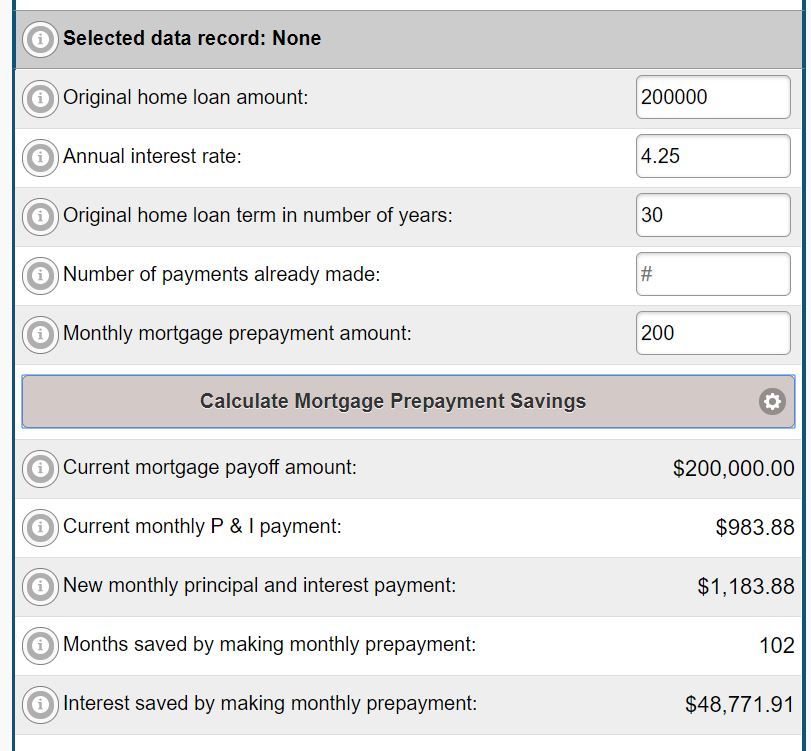

The first step is you need to enter the new loan amount and the interest rate.

Next you enter the amount of the savings and then click calculate.

In this example, I used a loan amount of $200,000 at 4.25% and a reinvested savings of $200 a month. It shows that the new mortgage would be paid off 102 months earlier.

If the current term remaining on the original mortgage is less than 102 months, then yes this is real savings.

Conclusion

I hope this post helps you determine if refinancing is right for you. If you have any questions, or would like a free mortgage review, please do not hesitate to reach out at 937-572-3713.

If the current term remaining on the original mortgage is less than 102 months, then yes this is real savings.

If the current term remaining on the original mortgage is less than 102 months, then yes this is real savings.